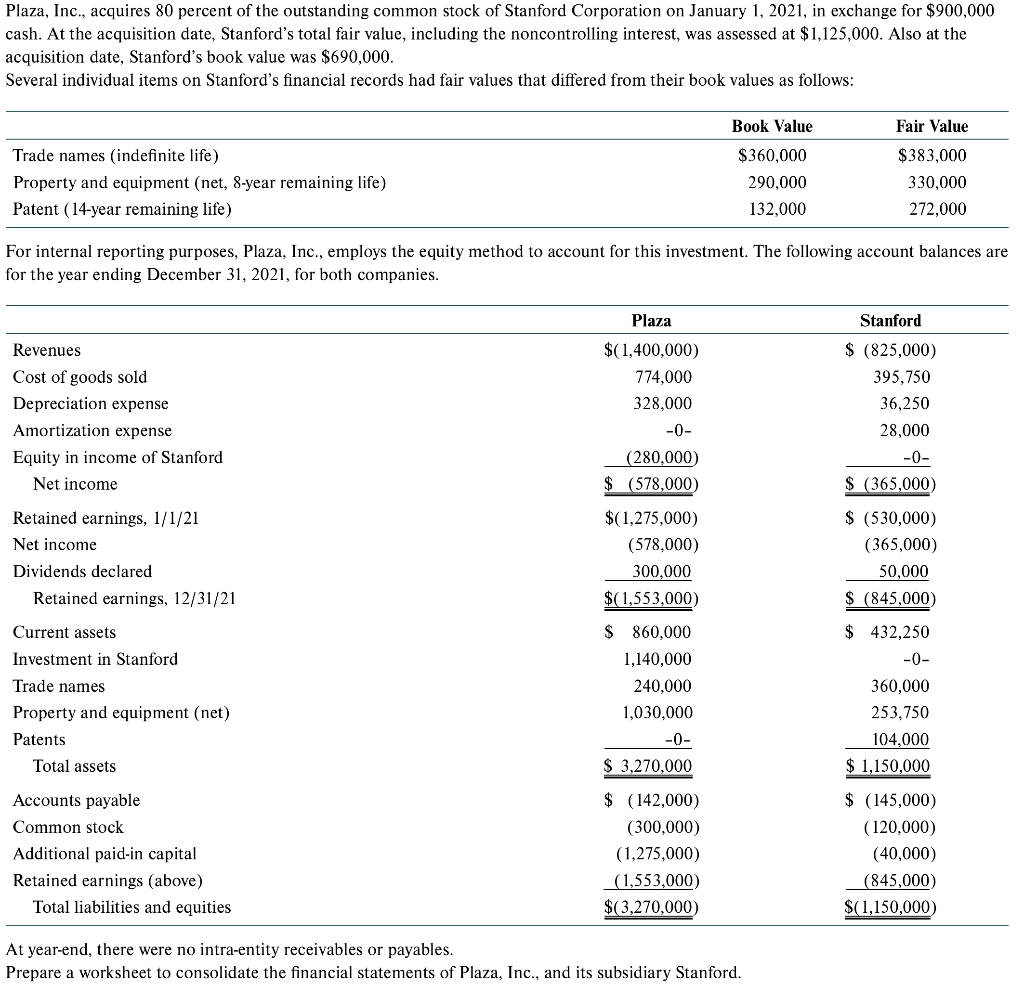

For your benefit, Flagstar Financial has actually an internet site for applicants in order to publish their records. There is an eClosing choice for consumers who don’t alive near an excellent Flagstar part.

Flagstar mortgage customer evaluations

Compared with almost every other creditors, Flagstar Lender has relatively couples complaints lodged on the Individual Economic Safety Agency (CFPB). When you look at the 2021, Flagstar had lower than one issue each step one,000 mortgages.

Full, homeowners check happy with the level of solution they discovered away from Flagstar. Many state its loans closed promptly, typically contained in this 31 so you’re able to forty five days.

Mortgage-relevant issues on big lenders

On the downside, Flagstar simply received a keen 822 out-of step 1,000 inside J.D. Power’s current mortgage customer satisfaction survey. Which was better beneath the mediocre rating away from 848.

Home loan issues within Flagstar Lender

- Old-fashioned loans: Buy a house which have a downpayment only 3%. In order to be eligible for a traditional mortgage, Flagstar requires a minimum credit rating off 620. Have fun with a traditional loan for a special home pick, an excellent re-finance, new construction, family renovation, otherwise purchasing a multi-tool assets

- FHA money: Such mortgage brokers are supported by brand new Federal Housing Management and you may require an effective step three.5% advance payment and a minimum credit score off 600. Use FHA money getting a unique pick, re-finance, framework, otherwise family renovation. Remember that this type of financial need financial insurance rates superior (MIP) to your life of the mortgage

- Virtual assistant financing: These types of money backed by the fresh You.S. Agency away from Pros Points appeal to productive-responsibility military, pros, Federal Guard service participants, Reservists, and their eligible partners. So you’re able to be considered, you need at least credit rating regarding 600. It is a zero-money-down financing

- USDA fund: It mortgage are insured from the You.S. Institution of Farming. To help you qualify, you should buy a house into the a qualified outlying area. Such money need no currency down, you you prefer at least credit rating away from 640

- Jumbo fund: Individuals are able to use good jumbo financing to acquire otherwise re-finance a great high-balance home (a property that exceeds the brand new conforming mortgage restrict lay because of the Freddie Mac computer and Fannie mae, that is currently $ for the majority areas). Flagstar lets financing quantities of to $3 million to possess first houses and you may $2.5 billion having 2nd property

Keep in mind that Flagstar Bank’s home loan credit history standards was a tiny higher than more lenders. It requires a rating of at least 600 to possess an enthusiastic FHA financing, although businesses go as low as 580.

If you find yourself longing for FHA financing which have an effective FICO score from the 580-600 variety, you are going to need to look someplace else.

Refinancing that have Flagstar Lender

- Rate-and-title re-finance: Selling and buying your own completely new financial with a new one which offers financing conditions which can be far more favorable

- Cash-away re-finance: Accessibility your home guarantee from the substitution your current mortgage with a great the newest, large loan amount, following finding the difference since a lump sum payment of cash

Instead, Flagstar consumers who are in need of to tap its guarantee but never wanna so you can re-finance can put on to own another mortgage – property security mortgage or HELOC – in look for says.

However, the lending company is actually registered to help you originate dig this loans in every fifty states and you can Arizona D.C., therefore deals with countless third-group financial originators, loan officials, and loan advisers.

If you’re in a state versus a good Flagstar branch venue, you could potentially control your mortgage payment on the web because of MyLoans, the new lender’s on line maintenance heart.

Was Flagstar an educated mortgage lender for your requirements?

If you are searching to own a conventional loan, regulators loan, jumbo financing, or perhaps a restoration or the new design financing, Flagstar Financial to you personally.