In this article:

- Can you use an unsecured loan to begin with a business?

- Where you might get a personal bank loan to begin with Your company

- Simply how much Might you Get in a personal bank loan to start Your business?

- The benefits and Cons of utilizing an unsecured loan to start a corporate

- Alternatives to presenting a consumer loan first off a business

- Get your Credit Ready for Business Investment

Taking money just like the a different business person are going to be incredibly hard. If you do not has actually good earnings and some many years in operation below your belt, you should have a hard time providing old-fashioned organization money.

What is actually leftover mainly boasts costly quick-title funds. However, one other solution you might believe try an unsecured loan. When you are considering performing a business, here is how a consumer loan might possibly help.

Do you require an unsecured loan first off a corporate?

Unsecured loans are among the very flexible types of borrowing available. Although some loan providers would limit the way to make use of your money-and to possess performing a corporate-there are certainly others that don’t tend to be business purposes on the exemption listing.

Lenders will get county on their website whether or not they ensure it is individuals so you can fool around with financing loans first off a business. If you fail to find that suggestions, it’s best to very carefully search through your loan agreement and get truthful regarding your objectives with the any models you fill out.

When you are nonetheless unsure, get in touch with the financial institution to allow him or her understand what you intend in order to make use of the currency to have and get if it’s deductible under the fine print. The financial institution can get prohibit borrowers by using its money to have business motives and can even wanted quick debt cost when it is calculated you achieved it in any event.

Where you’ll get a personal loan to begin with Your company

You can get a personal bank loan courtesy various kinds loan providers. Whatever the loan’s origin, although not, it is critical to understand that personal loan interest rates can differ dependent on your creditworthiness.

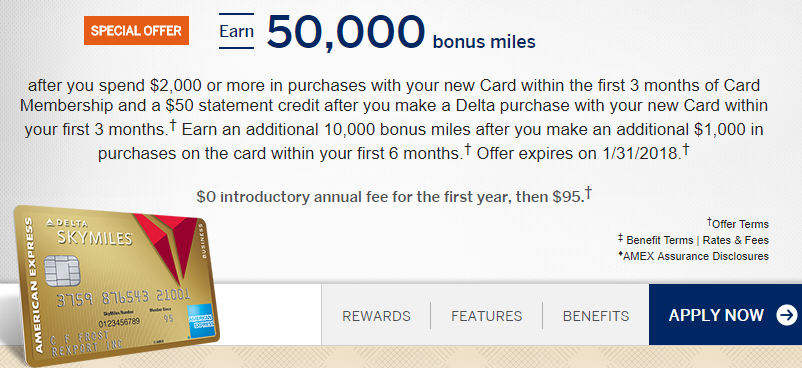

When you have expert borrowing from the bank, you may be able to be eligible for that loan with a keen interest regarding low solitary digits. If your borrowing from the bank was reasonable otherwise terrible, you may have a hard time qualifying getting a speed lower than 30%.

This is why, it is important to take time to buy as much as and you will contrast has the benefit of. Playing with Experian CreditMatch, you should buy coordinated to individualized loan has the benefit of out-of several loan providers under one roof predicated on the borrowing from the bank profile.

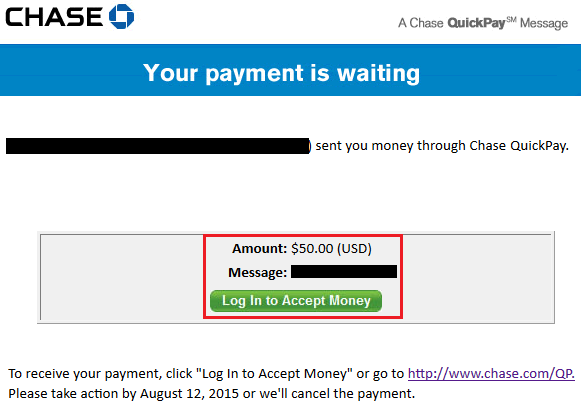

- Conventional banking companies: Specific huge banks for example Lender away from The united states and you may Chase do not provide unsecured loans. However, anybody else, along with Citi, Pick and Wells Fargo, perform. In addition, of numerous area banking institutions promote her or him. For those who lender which have a place that provides personal loans, find out if you’re able to obtain a good offer situated on your own reference to the bank.

- Borrowing from the bank unions: Borrowing unions generally bring most readily useful terms than just banking companies since they’re not-for-cash organizations owned by their people. Unlike returning profits in order to third-group investors, it use that money for the giving finest financing terms and conditions, also straight down fees and you can rates of interest. That is no guarantee you’re going to get a knowledgeable rates, however if you might be a member of a credit commitment, it is advisable to check on observe what’s offered.

- On the web lenders: Some of the finest personal bank loan also offers come from online lenders, which include conventional finance companies, on the internet lending platforms owned by banking institutions, or any other loan providers that do not render antique banking circumstances. In addition, all these lenders provide prequalified before you can use. This step cannot impact their credit and you may allows you to tribal loan quicker evaluate cost to find the best alternative for you.