Camper Funding

If you’re looking to find an auto using the financial support option (in place of refinancing a car loan), i recommend you can get the private Line of credit earliest, prior to the final buy from the dealer. Delight apply to a primary Republic banker observe what works best for you.

Play with our very own calculator to see the repaired rate of interest choice and you will projected monthly installments when using a primary Republic Private Distinct Credit for buying otherwise refinancing your auto loan.

The personal Credit line calculator will require your time from delivery and you can Social Protection matter doing a silky credit eliminate. This can perhaps not apply to your credit score.

The personal Line of credit cannot be utilized (certainly almost every other prohibitions) in order to refinance otherwise spend one Earliest Republic funds otherwise lines regarding borrowing from the bank, to invest in securities or financing activities, to own speculative aim, having business or commercial spends, and the newest head fee regarding blog post-secondary educational expenditures. The product cannot be always payoff credit card debt at origination.

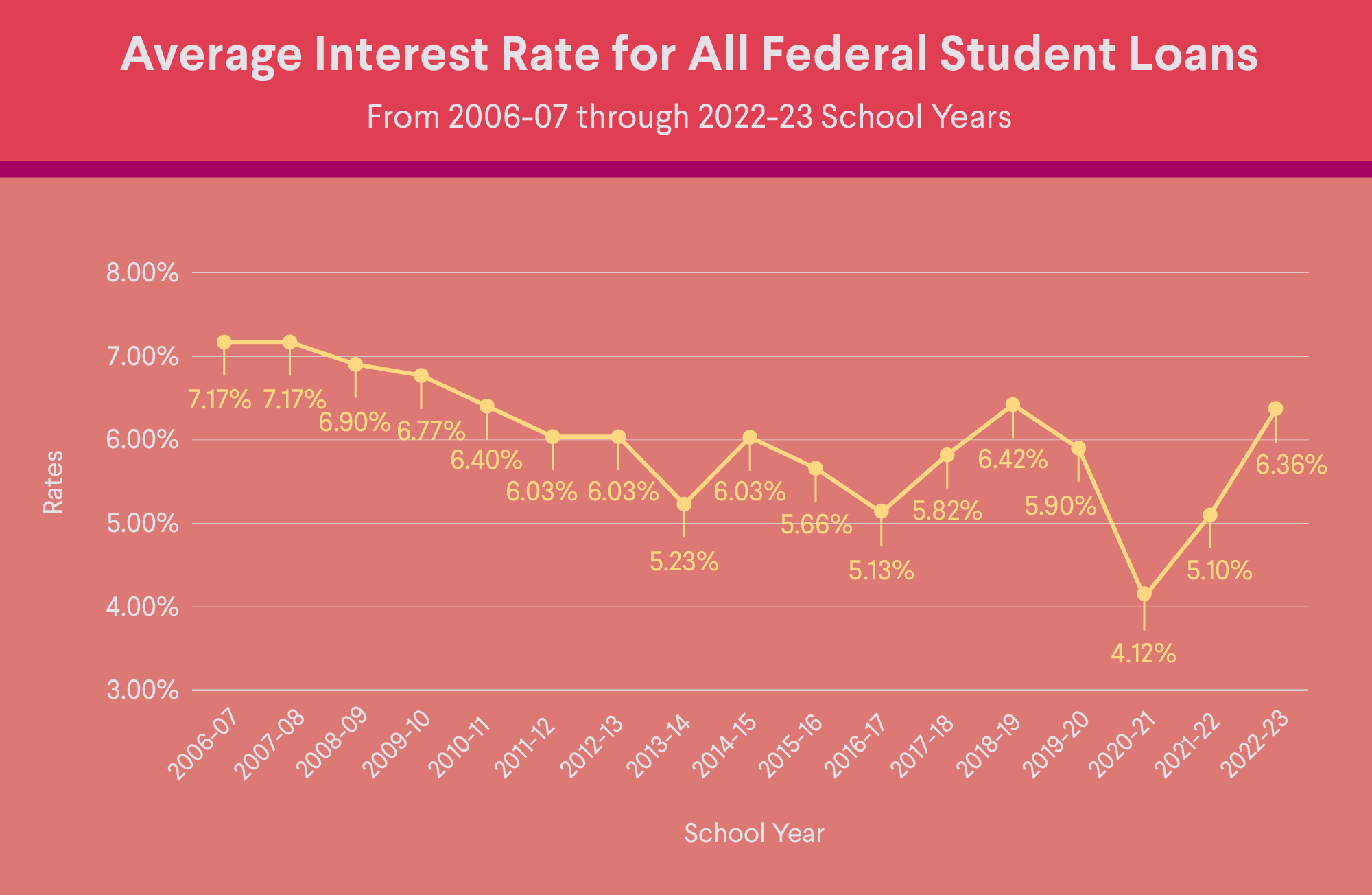

Note: Currently, all the costs without a doubt style of government college loans are frozen courtesy for each a professional acquisition by the President. Appeal cannot accrue during this time.

The personal Line of credit also provides a-two-12 months draw period having attract-only repayments, followed by a fees several months (sometimes also known as the fresh new amortization period) according to the loan identity. From inside the a couple of-season mark several months, you are going to pay notice only about what your draw and also you can build dominant payments any moment (without origination otherwise prepayment charges). Principal number paid off inside the two-12 months draw months are around for end up being borrowed again. During the payment period, you will be making dominating and attention money about remainder of your loan name.

- You’ll want a first Republic Automatic teller machine Promotion Bank account („Account“) that have vehicle-debit for your Credit line payments and you may head put of one’s main income source to own a 2% relationship-depending costs write off. If for example the Membership is signed, the pace increase by 5.00%.

- A low readily available speed is sold with a romance-founded pricing https://paydayloancolorado.net/dove-valley/ modifications to have maintaining 20% of your recognized amount on the Atm Promotion Savings account which have the possibility in order to put doing half you to definitely 20% towards an Eagle Invest membership.

- If you do not choose into people relationship-situated prices adjustments, a minimum $500 is needed to discover an atm Promotion Bank account. A monthly service commission (already $25) will pertain when the a good $3,five hundred required lowest mediocre equilibrium is not maintained.

Ideas on how to Re-finance an auto loan

1 Line of credit is an enthusiastic unsecured unsecured loan you to include a-two-seasons, interest-simply, revolving draw several months followed closely by a completely amortizing cost age of the rest of the word. Pulls commonly allowed for the installment period.

The merchandise can just only be used for personal, friends or household purposes. It can’t be taken for the following (certainly almost every other bans): to refinance otherwise spend any Basic Republic financing otherwise contours of borrowing, to get bonds otherwise resource facts (plus margin inventory and you may cryptocurrency), having speculative objectives, for team otherwise commercial spends, to have a down-payment into the people possessions or the fresh lead commission out of post-second educational expenses. The merchandise can not be regularly pay back credit card debt at the origination. Please note just bills that appear on your own credit rating statement or figuratively speaking are eligible getting paid down from the origination.

The brand new regards to the item can differ out of regards to the latest loan(s) that will be getting repaid, as well as not limited to student education loans. Of the paying down including funds, you may also forever be stopping income tax and you can repayment benefits, and forbearance, deferment and you will forgiveness, and be unable to reobtain for example benefits in the event that this mortgage is actually refinanced having various other lender down the road.